Comparing tax burden on property owners across Europe is a good thing that will help customers in selecting a country. Estonia, Slovakia and Sweden turned out to be almost free paradise, while in Switzerland, Italy and especially in France authorities rob owners blind.

Every year Organisation for Economic Co-operation and Development (OECD) publishes tax burden rating, where the member countries of the Organization range from the kindest to the most avaricious. Only one type of tax is important for us: property tax.

Property tax rating of countries (from the lowest – to the highest):

1. Estonia

2. Slovakia

3. Sweden

4. Ireland

5. Turkey

6. Finland

7. Czech Republic

8. Denmark

9. Norway

10. Germany

11. Slovenia

12. Luxembourg

13. Austria

14. Portugal

15. Hungary

16. Netherlands

17. Belgium

18. Greece

19. Poland

20. Iceland

21. United Kingdom

22. Spain

USA *

23. Switzerland

24. Italy

25. France

* for comparison

The final position in the rating is made up of three things, and tax on real estate is only one of them. The remaining two are wealth, gift and inheritance tax, as well as taxes on ownership of legal entities and on sale. How and the most importantly why OECD experts formed the last two indicators from completely different and disparate things remains a mystery, but we'll consider these three indicators too.

1. Property taxes in Europe

Estonia is the only one of all the countries in the rating, where property is not subject to annual taxes. You only need to pay for land, but not for objects that are located on it. It is not surprising that Estonia becomes the leader on this indicator of rating. It is followed by Turkey, Slovakia and even Finland, where the rate is 0.3-1.35% of housing price.

But at the other end there are countries where authorities drain owners dry. These are Italy, Iceland, the United Kingdom, and most of all France. At home of Balzac they do not take money only for air: there are property taxes, mandatory for all, there is a tax for living in a property, and even a tax for not living in it (a tax on vacant dwellings).

2. Wealth, gift, inheritance and property taxes in Europe

You bought a property in Europe and think that the annual tax and utility bills are the only upcoming expenses, do you? No way. And what if you want to sell or present your apartment? What if, God forbid, it is too expensive, and the authorities decide that you are rich enough to share your money with the state?

Decided register the apartment to your relative when you are late in life, for him not to pay inheritance tax? Kindly pay the gift tax. Received a property as an inheritance? Kindly pay in all European countries except Estonia, Slovakia and Sweden, where such taxes do not exist. That's where grandmothers are not worried that their grandchildren will get not only the house, but big expenses as well.

There are also wealth taxes. When your assets in the country exceed a certain amount (for example, you bought a house and a couple of apartments in different cities), the state begins to require annual payment. In Spain it is from 0.2% to 2.5% on the assets value form €700,000 (excluding primary residence). Similar picture is in France, Norway and Switzerland.

3. Taxes on legal entities and on real estate sale in Europe

Do you have a company registered in Luxembourg, but having real estate and bank accounts in all Europe? You'll have to pay into the budget of Luxembourg 0.5% of all assets, and not once but every year.

And there are sales taxes (in fact – purchase ones) on property. Buying a home can be free only in Estonia and Sweden. Given the abundance of cheap real estate in Estonia, it is a great gift from the state for all who want to buy it.

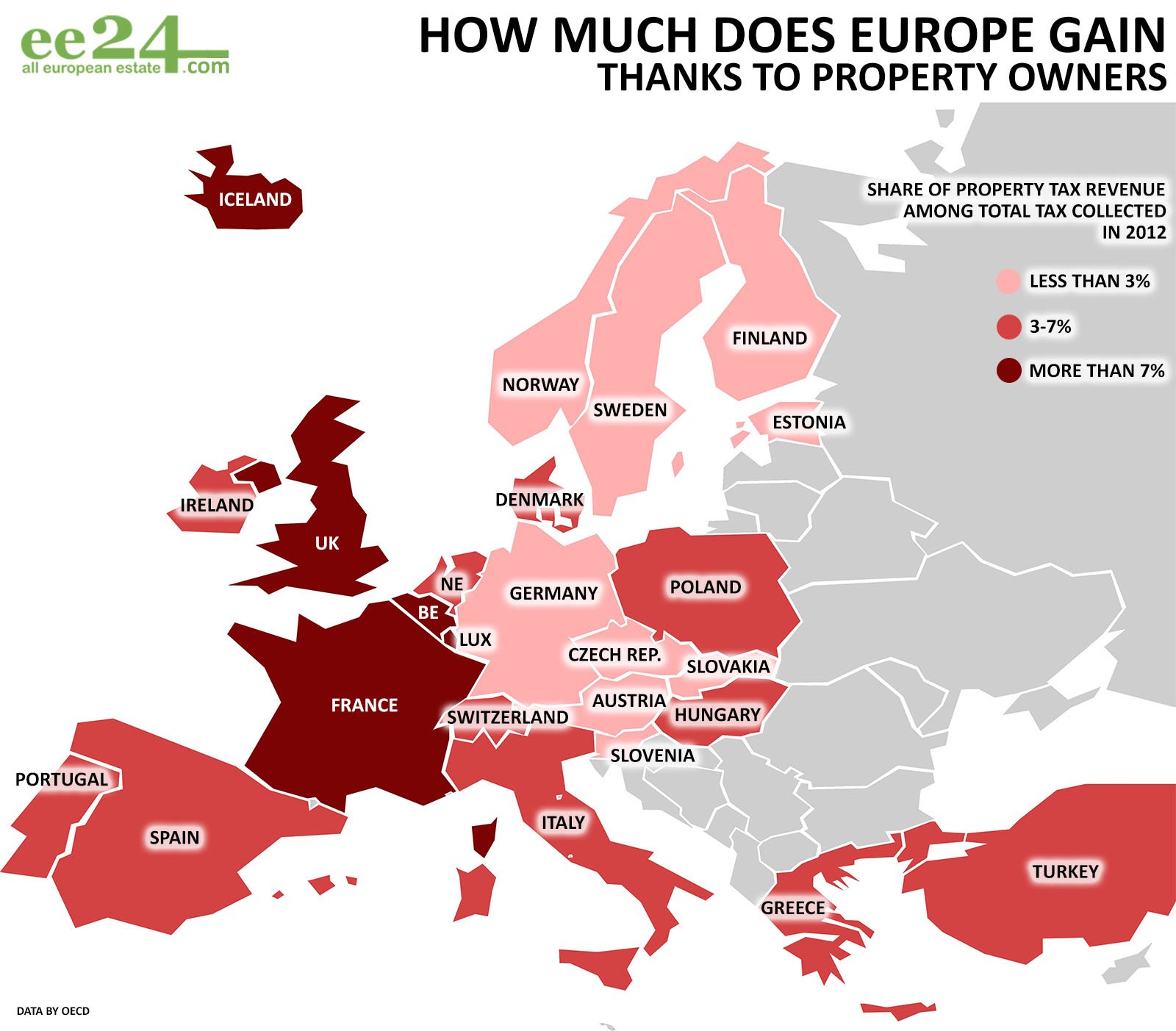

P.S. Countries, earning most of all from property owners

Many countries neither receive petrodollars, nor overstock the world with cheap clothing nor use cheap labor of multimillion population. But at the same time they earn on their own people – property owners.

It has been estimated that the property tax is the most important for the UK budget. Of all the taxes paid by the people of this country, it accounted for 11.9%. This is about £1 from £8. The remaining £7 go to the budget form taxes on income, profits and so on. But the budget of Estonia, by contrast, suffers from the fact that homeowners do not pay it.

See full size

Property taxes in the structure of all taxes (for 2012):

First positions:

United Kingdom (11.9%)

France (8.5%)

Belgium (7.5%)

Luxembourg (7.1%)

Iceland (7.1%)

Insignificant positions:

Estonia (1%)

Austria (1.3%)

Czech Republic (1.5%)

Slovakia (1.6%)

Slovenia (1.8%)

Text: Kirill Ozerov, ee24.com